Even crypto bulls expect more volatility for Bitcoin this year. But many think the path of least resistance is still higher, perhaps in 2026.

Bitcoin bulls are hoping that the world’s most valuable cryptocurrency will keep climbing. But even some crypto enthusiasts admit that Bitcoin continues to be incredibly volatile. It’s not digital gold just yet.

Bitcoin surged from about $70,000 just before the November presidential election to a record high of more than $100,000, largely due to expectations that President-elect Donald Trump and his regulatory regime will adopt far-friendlier policies related to crypto than the outgoing Biden administration.

“Trump’s election and implications that will have for regulations and policy is a catalyst for Bitcoin,” said Seth Hertlein, global head of policy with Ledger, a digital asset security firm, noting that changes in DC could be like “jet fuel” for crypto. “Prices could go higher…a lot higher,” he told Barron’s.

That may wind up happening. But experts expect more volatility for Bitcoin along the way.

For one, there are questions about how many willing buyers are out there beyond Michael Saylor’s software firm MicroStrategy, which recently disclosed plans to raise $2 billion to purchase even more Bitcoin.

The global markets strategy team at J.P. Morgan Securities wrote in a report Monday that MicroStrategy bought about $22 billion of the $78 billion in Bitcoin and crypto funds that were purchased in 2024.

“In other words, MicroStrategy’s bitcoin purchases alone accounted for 28% of last year’s record capital inflow into crypto markets,” the J.P. Morgan strategists pointed out.

But MicroStrategy, which now owns 447,470 Bitcoin worth about $43.6 billion at a current price of just above $97,000, probably won’t be the only big buyer of Bitcoin in 2025.

David Foley, co-managing partner of the Bitcoin Opportunity Fund, which invests in Bitcoin as well as MicroStrategy and other public and private companies that have ties to the cryptocurrency, said in an interview with Barron’s that there should be widespread interest from large institutional investors as well as more businesses looking to add Bitcoin to their corporate treasuries.

“You’re seeing a lot of small companies buying Bitcoin but not as many whales yet like MicroStrategy,” he said. “But bigger companies may take steps toward investing in Bitcoin.”

Larger firms may be waiting for Bitcoin to become less volatile, though. Foley pointed out that Bitcoin is still more highly correlated with riskier tech stocks than it is with gold.

Along those lines, Foley said he could see Bitcoin tumbling back to $70,000 this year if “the Trump halo fades” due to concerns about tariffs and if there is broader market volatility that hurts the Nasdaq Composite

But Foley added that Bitcoin could climb as high as $200,000 in 2026, especially if the government sets up a Strategic Bitcoin Reserve, which has been proposed by Sen. Cynthia Lummis (R., Wyo.).

“Ultimately, Bitcoin is digital gold,” Foley said. “At some point, Bitcoin will become a risk-off asset like gold.”.

“Ultimately, Bitcoin is digital gold,” Foley said. “At some point, Bitcoin will become a risk-off asset like gold.”

It just may take some time for Bitcoin to get there though.

“There is the case to be made that Bitcoin has the green shoots of becoming something like gold over time. But it’s still a speculative asset for now,” said Wasif Latif, co-founder and chief investment officer of San Antonio-based money manager Sarmaya Partners, in an interview with Barron’s.

Latif noted that Bitcoin needs to become less volatile before the comparisons to gold are truly apt.

“ Gold is established as a safe haven and inflation hedge. It has a 5,000-plus-years history,” he said. “Bitcoin is new. It’s like a baby. It will get there but it won’t be immediate.”

In other words, Bitcoin prices may fluctuate much more wildly (to the upside and downside) for the foreseeable future. Gold is still, at the end of the day, a much more stable store of value than Bitcoin.

S&P 500 index funds FAQ

Which is the best S&P 500 index fund?

All S&P 500 index funds strive to match the returns of the S&P 500 index minus fees. Since fees are the difference maker in returns, the Fidelity 500 Index Fund stands out as the best-performing S&P 500 index fund. It has the lowest expense ratio of the top funds, so its returns are slightly higher than other top S&P 500 index funds.

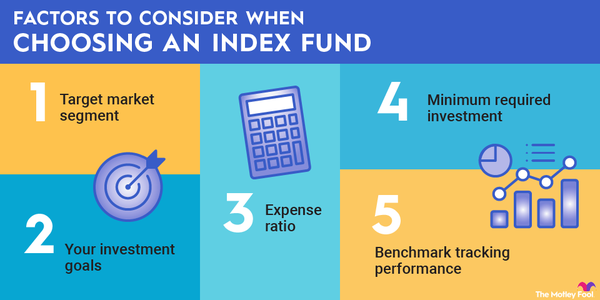

How do I choose an S&P 500 index fund?

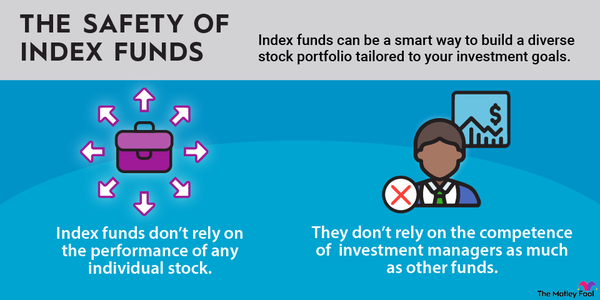

Because the underlying investment is the same for any S&P 500 index fund, you'll get very similar returns with any fund you choose. To choose a fund, look for one with low fees and one that doesn't require a large minimum investment.

Which index funds give the best returns?

S&P 500 index funds have some of the most consistently strong returns over long holding periods. Over the last 30 years, the S&P 500 has delivered a compound average annual growth rate of slightly more than 10%, assuming dividend reinvestment. That has outpaced many other investments, like cash, bonds, and gold.

What index is better than the S&P 500?

The answer depends on your investment goals. For example, if you're seeking high growth and are willing to accept more risk, you might want to invest in a fund that tracks the tech-heavy Nasdaq-100 index.

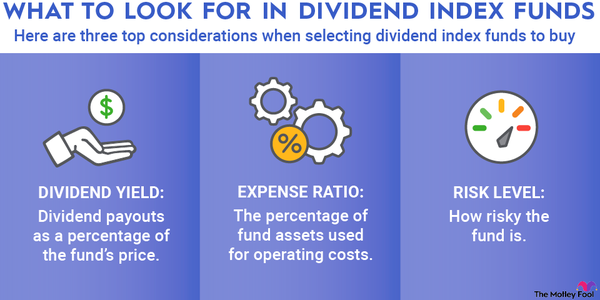

If you're seeking income-producing investments, you could buy an index fund that tracks the S&P 500 High Dividend index. This index tracks the performance of 80 companies in the S&P 500 and has a long track record of paying above-average dividends.

Is the S&P 500 ETF a good investment?

There are several S&P 500 ETFs. Like the index funds discussed in this article, they each use the S&P 500 index as their benchmark. Historically, funds that track the S&P 500 index have been good investments in the long term.