As 2025 approaches, I wanted to share my three favorite stocks from the energy, consumer staples, and technology sectors that I currently hold in my personal portfolio. As a former investment fund analyst, I focus on these three sectors, and all three stocks have strong growth momentum and attractive valuations. Not only do they come from different industries, they also provide diversity to a portfolio. I believe that these three stocks are worth holding in the next three years or even longer.

1.Energy Transfer

1.Energy Transfer

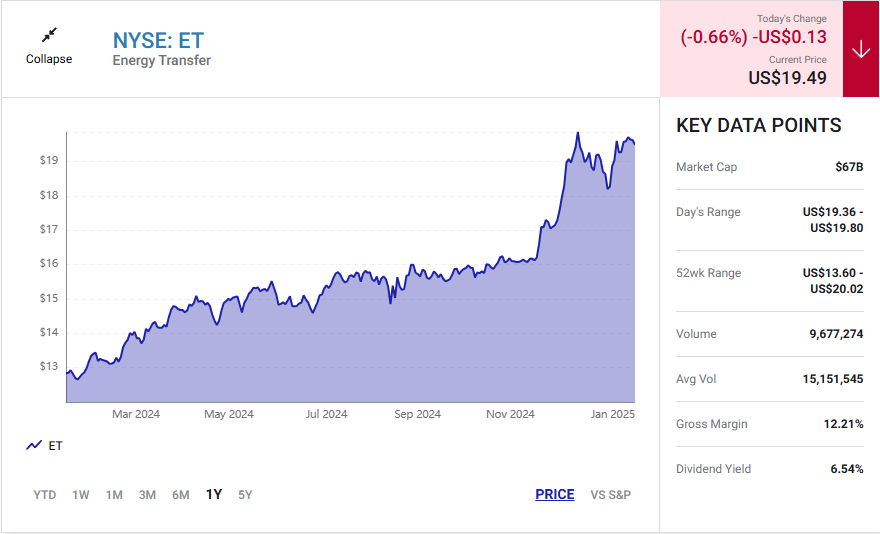

Energy Transfer (ticker: ET) is one of the largest integrated midstream energy companies in the United States, transporting, storing, processing and upgrading natural gas, natural gas liquids (NGL), crude oil and refined products such as gasoline. Thanks to its massive system and diversified operations, Energy Transfer is able to capture a variety of energy arbitrage opportunities. For example, companies can earn higher profits by transporting natural gas from regions with lower prices to markets with higher demand, or by upgrading natural gas liquids (NGLs) such as ethane into ethylene.

Of particular note, Energy Transfer’s system is well-suited to take advantage of the increased demand for electricity brought about by artificial intelligence (AI). Because natural gas is relatively cheap in the Permian Basin, the company is able to tap into the region's cheap natural gas to support more energy projects. The Permian Basin is a major oil basin with limited natural gas export capabilities, making it one of the cheapest areas for natural gas in the United States. In fact, in 2024, natural gas prices in the Permian region fell to negative values.

Recently, Energy Transfer announced a $2.7 billion natural gas transmission project to support power plants and data centers in Texas. This move demonstrates the company's potential in the energy transition.

From a valuation perspective, Energy Transfer trades at a discount relative to its peers, with an enterprise value (EV) to EBITDA ratio of just 8.4x. By comparison, its master limited partners (MLPs) traded at 13.7 times earnings between 2011 and 2016. Combined with growth potential, valuation advantages, and a more favorable energy regulatory environment, I think Energy Transfer is a quality stock to own for the next few years.

Additionally, the company has a forward yield of 6.6% and expects dividends to grow at a rate of 3% to 5%.

2.Elf Beauty

Elf Beauty (ticker: ELF) is not only one of the fastest-growing companies in the consumer products industry, but it's also known for its very attractive valuation.

The company has successfully penetrated the cosmetics market through influencer marketing and a strategy of imitating well-known brands, especially among young consumers. As its brand awareness has grown, Elf's products have rapidly occupied retail shelves over the past few years and have established a significant presence in the mass cosmetics market.

In addition, Elf Beauty's products have also achieved significant success in the international market, quickly becoming a leading brand in the cosmetics market in many countries, especially in the new markets it has entered. But the most exciting thing is that Elf's growth potential is not limited to cosmetics, it also plans to expand into skin care products. Elf currently has two fast-growing skin care brands, one of which is its main brand and the other, which is slightly more expensive, Naturium. In addition, perfume and hair care products may also become Elf's future business expansion direction.

Recently, Elf's sales have grown 40% while it trades at a forward price-to-earnings ratio of 28.5 and a price-to-earnings growth (PEG) ratio of 0.5. Generally speaking, stocks with a PEG below 1 are considered undervalued, especially for growth stocks. As a result, Elf's stock looks very attractive at this valuation level.

3.Alphabet

In the tech space, I'm very bullish on Alphabet (ticker: GOOGL/GOOG). As the global search market leader, Alphabet's Google not only dominates the search engine field, but also owns YouTube, one of the world's largest video streaming platforms. In addition, Alphabet operates the world's leading advertising technology platform, supporting advertising revenue for Google, YouTube and other properties such as Gmail and Google Maps.

Alphabet’s advertising technology will become a powerful driver of the company’s future AI business growth. As AI continues to advance, Google expects to be able to create new ad formats for its search results and start generating revenue from the 80% of search queries that are currently unmonetized.

In addition, Alphabet also owns Google Cloud, the world's third largest cloud computing business. Of the three major cloud computing companies, Google Cloud is the fastest growing, with revenue growing 35% last quarter. The cloud computing business has high fixed costs, and Google has recently reached an inflection point where it is starting to drive profitable growth through improved utilization. Last quarter, Google Cloud's operating income soared from $266 million to $1.95 billion.

In addition, Alphabet has also made important progress in a number of emerging fields, including quantum computing and autonomous driving technology. Waymo, Alphabet's self-driving unit, has become the only company currently offering a paid self-driving taxi service.

At just 18.5 times forward earnings, investors can get exposure to these businesses, making Alphabet one of my favorite tech stocks.

How to Buy Stocks FAQ

How should a beginner invest in stocks?

It is easier than ever for beginners to buy stocks, thanks to the emergence of several user-friendly trading platforms, many of which allow beginners to buy stocks quickly and easily through an app. If you don't want to pick your own stocks, however, another good option for beginners is to use a robo-advisor service, which can invest in exchange-traded funds (ETFs) on your behalf.

Can I buy stocks with $100?

Even if a stock is trading for more than $100 per share, you still may be able to invest with just $100. Many brokers offer fractional share investing, and this can allow you to buy less than a full share of stock -- as little as a dollar's worth in many cases.

Which stock is best for beginners?

It's tough to give an exact number, since everyone's financial circumstances are different. However, some good guidelines are not to invest any money in stocks that you'll need within the next several years, and also not to invest if you aren't willing to watch the value of your investments rise and fall regularly.

How much should a beginner invest in stocks?

There's no perfect amount for a beginner to invest in stocks, since every investor has a different income and overall financial situation. However, it's a good idea to invest in stocks with money you know you aren't going to need for at least the next few years.