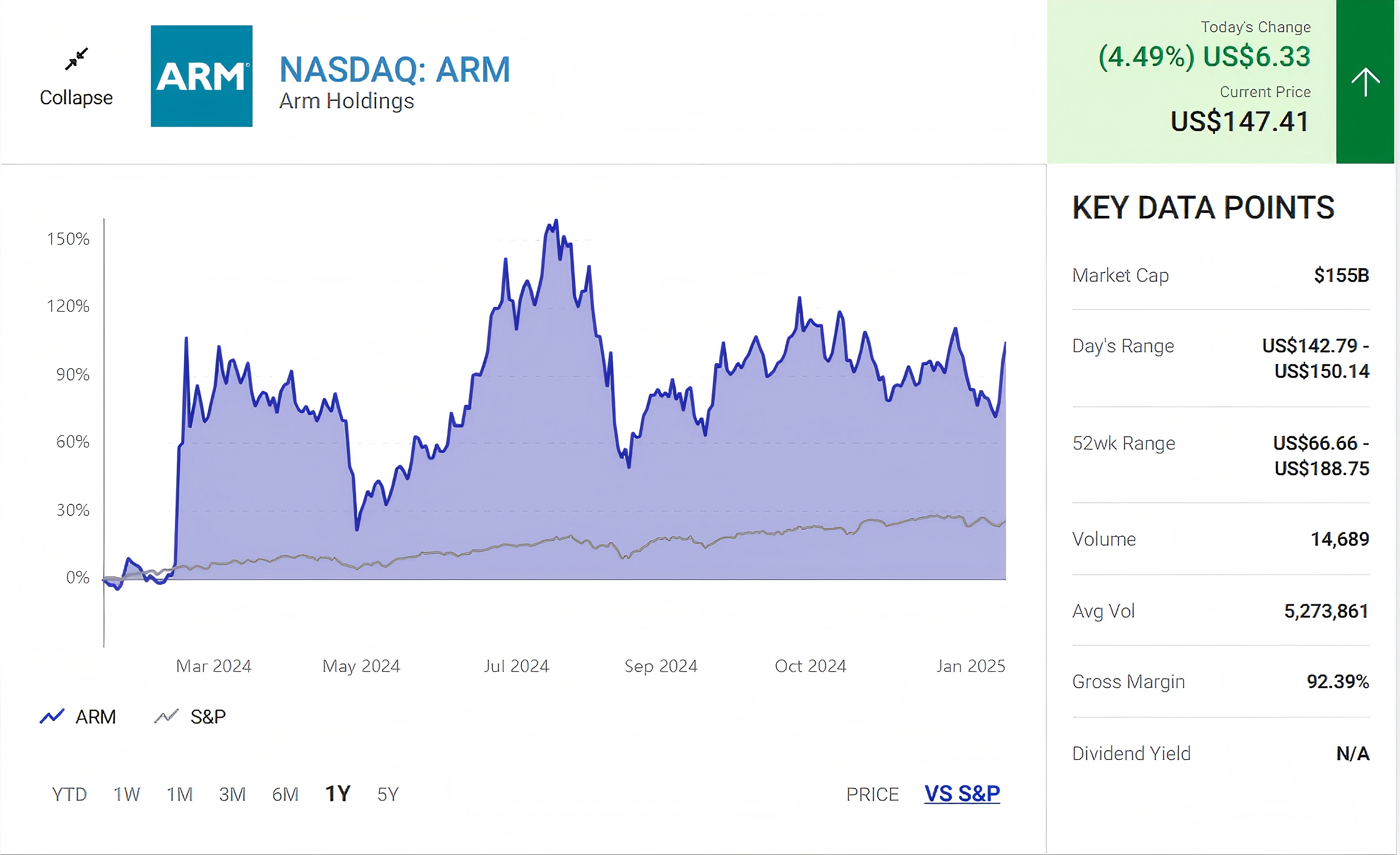

With the rapid growth of Arm Holdings (ARM) in 2024 and beyond, more and more investors are paying attention to the semiconductor company with a market cap of approximately $148 billion. Arm's core technologies play a vital role in AI hardware and energy-efficient computing infrastructure. With the growing demand for low-power, high-performance computing platforms, especially in artificial intelligence and the Internet of Things (IoT), Arm's market position is expected to further solidify, making it possible for it to surpass Palantir Technologies' market cap by 2025.

1. Arm's unique advantage: low power architecture

One of Arm's biggest strengths is its low-power architecture, which makes its products ideal for mobile devices, iot devices, and artificial intelligence applications. There is an increasing need for energy savings in these markets, especially in data centers and AI training/reasoning tasks, and Arm's technology provides a higher energy efficiency ratio, helping enterprises reduce operating costs.

2. The need for artificial intelligence and data centers

With AI booming, and the demand for generative AI and large-scale AI training in particular increasing dramatically, Arm's technology provides an ideal hardware platform for compute-intensive applications. While NVIDIA is the leader in AI hardware, Arm is attracting a growing number of data center and cloud companies with its low-power, customizable design. There is an increasing demand for energy-efficient hardware in AI training and reasoning, and Arm will undoubtedly take a larger share of that.

3. Price targets for investors and analysts

Many Wall Street analysts are confident in Arm's future and have set relatively high price targets that support it becoming a serious equity contender in the market by 2025. Here are some of the analysts' target price forecasts:

Morgan Stanley analyst Lee Simpson: Target price is $175 per share.

Evercore analyst Mark Lipacis: Target price is $176 per share. Bank of America analyst Vivek Arya: Target price is $180 per share.

Loop Capital analyst Ananda Baruah: Target price is $180 per share.

These price targets are in the range of Arm's $182 billion market cap, indicating a high level of market recognition of its growth potential.

4. Global leader in mobile devices and AI hardware

Arm's core business is based on the processor architecture it designs, and its technology is widely used in multiple consumer electronics sectors such as smartphones, tablets, smart TVS, and home devices. With the rise of emerging technologies such as 5G, the Internet of Things (IoT), and autonomous driving, Arm's technology will become even more important. In addition, Arm's breakthroughs in AI and big data processing have further consolidated its position in the global semiconductor market.

5. Arm's cooperation with major chip manufacturers

Arm works closely with many of the world's leading chip manufacturers, such as Qualcomm, Apple, NVIDIA, and others. Apple is one of the biggest customers of Arm architecture, with its M1 and M2 series of chips based on Arm designs, which have been hugely successful in the smartphone and PC markets. In addition, companies such as NVIDIA have also adopted Arm architecture in their high-performance computing platforms. As more enterprises realize the need for computational efficiency in AI and big data processing, the advantages of the Arm architecture will become more prominent, further driving its market share expansion in the data center and AI hardware space.

6. Arm's unique market positioning: Competition and opportunity

While giants like Nvidia dominate the AI hardware market, Arm's low-power architecture makes it incomparably competitive in applications where energy efficiency is Paramount. Especially when it comes to AI reasoning and edge computing, Arm's advantages in cost effectiveness and energy efficiency allow it to provide suitable technology solutions for some large enterprises.

In addition, Arm's customizability and licensing model have made it widely recognized in the global market. With the growth of iot devices and edge computing platforms, Arm will benefit from this trend, which is likely to see explosive growth in the coming years.