1. Nvidia (NVDA)

Sector: Semiconductors / AI Hardware

Why Buy:

-AI Chip Dominance: Nvidia is a dominant player in the AI hardware space, particularly with its Graphics Processing Units (GPUs), which are essential for machine learning and deep learning workloads. Their A100 and H100 GPUs are at the heart of AI research and the development of powerful AI applications.

-Data Centers and Cloud: Nvidia's GPUs are widely used in data centers by companies running AI models. As demand for AI grows, Nvidia's sales from this segment continue to skyrocket.

-AI and Gaming: Nvidia’s dominance isn’t just in data centers—it’s also expanding into gaming, autonomous driving, and edge AI devices. Nvidia's Omniverse platform is rapidly gaining traction for building virtual worlds and digital twins, which further drives AI adoption.

-Strong Financials: Nvidia’s market leadership, strong financials, and rapid growth in the AI space make it one of the most attractive investments for 2025.

Key Metrics:Key Metrics:

Market Capitalization: $1.1T+

Recent Growth: 50%+ revenue growth in the last year, driven by AI demand.

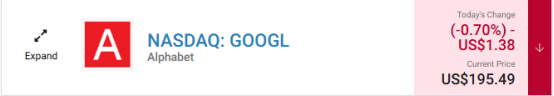

2. Alphabet (GOOGL)

Sector: Internet Services / AI Research

Why Buy:

-AI Leadership with Google: Alphabet’s Google is a global leader in AI research and development, with a focus on natural language processing (NLP), machine learning, and AI-driven search algorithms.

-Google Cloud and AI: Google Cloud is heavily integrating AI capabilities, from AI tools like TensorFlow (used by companies for machine learning) to generative AI models and data analytics tools. Google’s AI-first strategy positions it as a key player in the future of cloud computing.

-Self-Driving Cars: Alphabet’s Waymo division continues to develop self-driving cars, and AI is the backbone of their autonomous driving technology.

-Generative AI: Alphabet is heavily involved in generative AI with products like Bard (Google’s AI chatbot) and DeepMind’s cutting-edge AI models.

Key Metrics:Key Metrics:

Market Capitalization: $1.7T+

Revenue Growth: Steady growth in advertising, cloud, and AI.

3. Microsoft (MSFT)

Sector: Software / Cloud Computing / AI

Why Buy:

-AI Integration Across Products: Microsoft is seamlessly integrating AI across its cloud platforms, productivity tools (like Microsoft Office 365), and even gaming services. AI-powered features like Copilot in Microsoft 365 use OpenAI models to enhance productivity and decision-making.

-Azure AI: Microsoft’s cloud division, Azure, is a key beneficiary of the growing demand for AI services. Azure AI offers a suite of AI tools and services for businesses and developers, enabling them to build their AI-powered solutions.

-OpenAI Partnership: Microsoft has a significant stake in OpenAI, the creator of GPT models and other generative AI technologies. This relationship gives Microsoft exclusive access to OpenAI’s advanced AI capabilities, enhancing their products and services.

-AI in Healthcare: Microsoft’s AI for Health initiative is revolutionizing healthcare, using AI to solve major medical challenges, including personalized medicine and disease prediction.

Key Metrics:Key Metrics:

Market Capitalization: $2.5T+

Revenue Growth: Strong performance from cloud services, AI tools, and software..

Conclusion:

These 3 companies—Nvidia, Alphabet, Microsoft, Amazon, and Arm Holdings—are all key players in the AI revolution, each contributing to the sector’s growth in unique ways. Whether through AI-driven hardware (like Nvidia and Arm), cloud AI services (Microsoft and Amazon), or AI in search and advertising (Alphabet), these companies are poised to benefit significantly from the ongoing shift toward AI. Investing in these tech giants could provide substantial exposure to the growing AI market in 2025 and beyond

Which Stock Should You Buy in Your Next Trade?

With stock valuations skyrocketing in 2024, many investors are hesitant to allocate more funds into the market. If you're unsure where to invest next, consider accessing our proven portfolios to discover high-potential opportunities.

In 2024 alone, Team BullMax identified two stocks that surged over 150%, four stocks that jumped over 30%, and three others that climbed over 25%. This impressive track record is worth noting.

With portfolios tailored for Dow stocks, S&P stocks, tech stocks, and mid-cap stocks, you can explore a variety of wealth-building strategies.