The rise of Artificial Intelligence (AI) is reshaping multiple industries, from semiconductors to cloud services. AI offers companies competitive advantages, helping them increase efficiency, reduce costs, and enhance customer experience. For investors, this means AI technology has the potential to drive significant growth and appreciation in stocks.

Image source: Getty Images.

The following three stocks are well-positioned to benefit from AI’s revolution and have shown strong growth even during challenging economic conditions. They combine excellent fundamentals, competitive advantages, and growth potential. Here's a closer look:

1. Axcelis Technologies, Inc. (ACLS)

-Market Cap: $4.10B

-Quant Rating: Strong Buy

-Industry: Semiconductor Materials and Equipment

Why Buy?

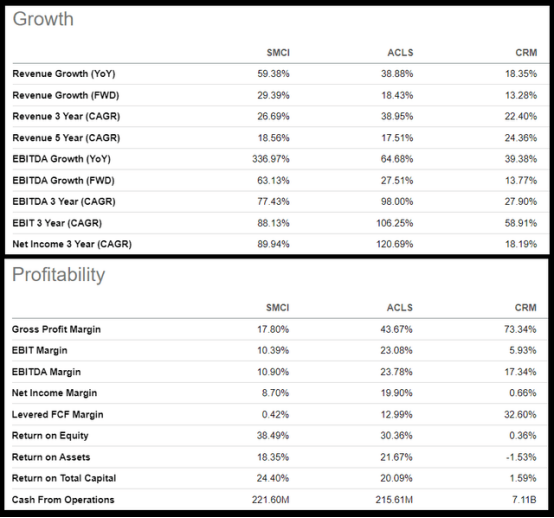

Axcelis Technologies is a leader in semiconductor ion implantation systems, a technology crucial for AI development, electric vehicles, and the Internet of Things (IoT). The company is benefiting from the demand for AI-driven products, with strong earnings beats and revenue growth. Axcelis has a bullish momentum and is well-positioned to continue growing, especially with a backlog of over $1.1 billion.

Financial Strength?

-Valuation: ACLS is trading near its 52-week high but still relatively discounted compared to its peers

-Growth: The company has exceeded earnings expectations with a forecast of $1 billion in revenue for the year, representing 8% growth despite overall industry challenges.

-Profitability: Strong profitability with gross margins of approximately 41.5%.

2. Super Micro Computer, Inc. (SMCI)

-Market Cap: $5.7B

-Quant Rating: Strong Buy

-Industry: Cloud and Software

Why Buy?

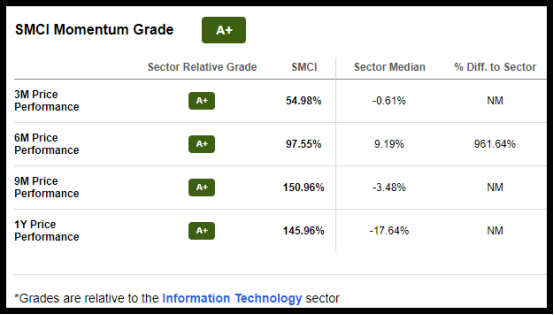

Micro Computer manufactures high-performance server and storage solutions essential for AI workloads, including high-performance computing (HPC). The company's strong relationship with Nvidia (NVDA) has positioned it at the center of AI demand. SMCI is capitalizing on the rapid growth of AI and data centers, with significant upside potential driven by its low valuation and robust momentum.

Financial Strength?

-Valuation: SMCI trades at an extreme discount, with a forward P/E ratio well below its sector.

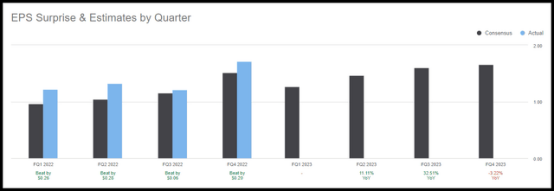

-Growth: The company is expecting revenue growth between 25% and 44% YoY for FY23

-Profitability: Operating margins up 12.8%, with growth of 54% YoY in revenue during Q2 2023.

3. Salesforce, Inc. (CRM)

-Market Cap: $197.51B

-Quant Rating: Strong Buy

-Industry: Cloud Computing & Software

Why Buy?

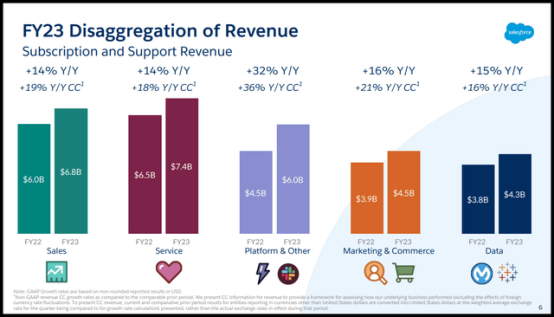

Salesforce is leveraging AI to enhance its Customer Relationship Management (CRM) solutions. The introduction of Einstein GPT, a generative AI tool, transforms customer interactions and offers personalized solutions at scale. The company continues to dominate the Sales Force Automation (SFA) space, with impressive growth metrics and strong market share.

Financial Strength?

-Growth: Salesforce has consistently delivered double-digit growth, with a 14% YoY revenue increase to $8.38 billion.

-Profitability: Operating margins have surged to 29.2% from 15%, reflecting the growing profitability of AI-driven services.

Strong Demand: With a forward PEG ratio of 1.14x, Salesforce is maintaining bullish momentum, with analysts revising earnings estimates up.

Risks to Consider

-Geopolitical Risks: Tensions, particularly between China and Taiwan, could disrupt the semiconductor supply chain.

-Volatility: Tech stocks, especially in AI, can experience significant price swings based on market conditions and innovation cycles.

-Macroeconomic Headwinds: High inflation, interest rates, and currency fluctuations can impact profitability, particularly in global markets.

Conclusion:

While the broader tech sector faces challenges, stocks tied to AI like Axcelis Technologies (ACLS), Super Micro Computer (SMCI), and Salesforce (CRM) stand out with their strong fundamentals, impressive growth rates, and market dominance in AI applications. These companies are poised to benefit from the ongoing AI revolution, offering a unique opportunity for long-term investors looking to capitalize on AI’s transformative impact on industries.

Which Stock Should You Buy in Your Next Trade?

With stock valuations skyrocketing in 2024, many investors are hesitant to allocate more funds into the market. If you're unsure where to invest next, consider accessing our proven portfolios to discover high-potential opportunities.

In 2024 alone, Team BullMax identified two stocks that surged over 150%, four stocks that jumped over 30%, and three others that climbed over 25%. This impressive track record is worth noting.

With portfolios tailored for Dow stocks, S&P stocks, tech stocks, and mid-cap stocks, you can explore a variety of wealth-building